In real estate, the concept of land ownership is often associated with outright purchase. However, there is a lesser-known yet incredibly powerful approach known as a ground lease.

By understanding the intricacies of ground leases, investors and developers can tap into a world of untapped potential.

Jump to FAQs

What is a Ground Lease?

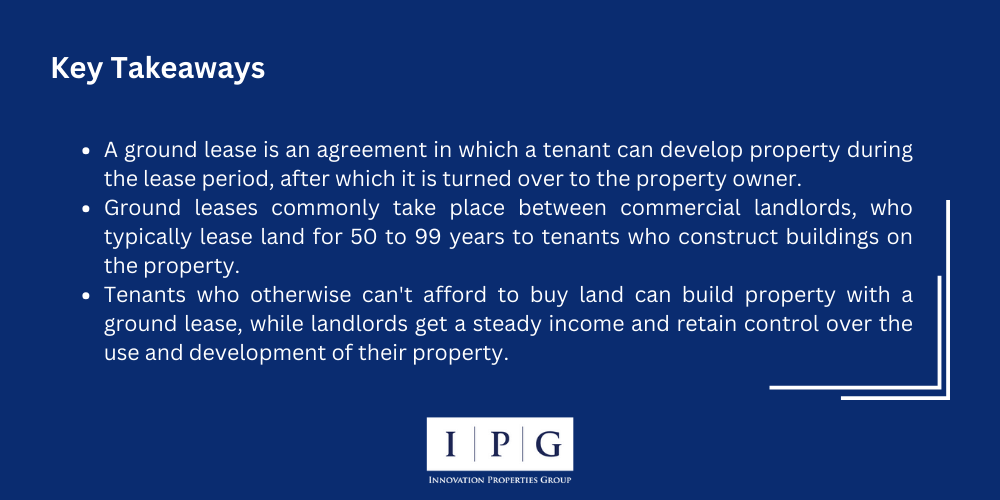

Ground lease is a unique arrangement where a property’s land is leased to a tenant, while the ownership of the land itself remains with the landlord. This arrangement enables tenants to utilize the land for various purposes, such as development or commercial activities, while paying rent to the landowner.

Ground leases are typically long-term, often spanning several decades, providing stability and a sense of security to both parties involved.

The Benefits of Ground Lease

- Flexibility and Cost-Efficiency: Ground leases offer a flexible alternative to traditional land ownership, allowing tenants to utilize land without the need for significant upfront capital investment. This makes it an attractive option for businesses and developers looking to minimize costs while maximizing their potential.

- Unlocking Development Opportunities: Ground leases provide an avenue for developers to access prime locations that may otherwise be financially prohibitive. By leasing the land instead of purchasing it outright, developers can allocate their capital toward construction and development, ultimately unlocking the potential for groundbreaking projects.

- Tax Advantages: Ground lease arrangements can provide certain tax advantages, such as the ability to deduct lease payments as a business expense. This can result in substantial savings for tenants, making ground leases a financially viable option.

A Win-Win Scenario

Ground leases present a win-win scenario for both landlords and tenants. Let’s explore the benefits for each party:

Benefits for Landlords

- Steady Income Stream: Ground leases provide landlords with a predictable and consistent income stream. By leasing the land, landlords can generate long-term rental income without the need for direct involvement in the development or operation of the property.

- Preserving Asset Ownership: Landlords retain ownership of the land, which ensures the long-term appreciation and value retention of the asset. This allows landlords to capitalize on the potential appreciation of the land while still benefiting from the income generated through the ground lease.

Benefits for Tenants

- Access to Prime Locations: Ground leases offer tenants the opportunity to access prime locations that may be otherwise unattainable due to high land acquisition costs. This allows businesses to establish a presence in desirable areas and leverage the advantages associated with strategic locations.

- Capital Preservation: By opting for a ground lease instead of purchasing the land, tenants can preserve their capital for other crucial aspects of their business, such as expansion, marketing, or hiring. This financial flexibility is a significant advantage for businesses aiming for sustainable growth.

Ground Lease vs. Traditional Ownership: A Comparative Analysis

To truly appreciate the potential of ground leases, it is essential to compare them with traditional ownership models. Let’s explore the key differentiators:

| Ground Lease | Traditional Ownership | |

|---|---|---|

| Initial Investment | Lower upfront costs, as tenants lease land instead of purchasing it | Higher upfront costs for land acquisition |

| Flexibility | Greater flexibility, allowing tenants to allocate resources elsewhere | Limited flexibility, with higher maintenance and ownership responsibilities |

| Risk Sharing | Landlord retains ownership risk, while tenant focuses on operations | Full ownership risk lies with the property owner |

| Cash Flow | Steady rental income for the landlord throughout the lease term | Potential cash flow fluctuations for the property owner |

| Opportunity Cost | Tenants can invest capital in business growth rather than land acquisition | Opportunity cost of tying up capital in land ownership |

The Process of Ground Lease: How it Works

Let’s dive into the step-by-step process of establishing a ground lease:

Step 1: Identifying the Landowner

The first step is to identify the landowner who is open to entering into a ground lease agreement. This could be an individual, corporation, or even a government entity.

Step 2: Negotiating Lease Terms

Once the landowner is identified, negotiations begin to determine the lease terms. This includes factors such as lease duration, rental payments, escalation clauses, and potential development restrictions.

Step 3: Drafting the Ground Lease Agreement

With the lease terms agreed upon, a legal professional drafts the ground lease agreement. This document outlines the rights and responsibilities of both parties, ensuring clarity and protection for all involved.

Step 4: Securing Financing and Permits

Tenants may need to secure financing for development or construction activities. Additionally, they must obtain any necessary permits or approvals from local authorities before commencing work on the leased land.

Step 5: Developing the Property

Once all legal and financial aspects are in place, tenants can proceed with the development or construction of the property according to the terms specified in the ground lease agreement.

Common Mistakes in Ground Leasing

Ground leasing can be a complex venture with several potential pitfalls. Here are common mistakes to avoid:

Insufficient Due Diligence

Before signing a ground lease, thorough research is essential. Verify the landlord’s ownership, assess accessibility, and check zoning restrictions. Consulting legal experts and conducting comprehensive research can prevent future issues.

Ignoring Long-Term Market Changes

Ground leases often span several decades, during which market conditions can change significantly. Failing to account for long-term market trends can lead to poor investment decisions. Understanding future market dynamics is crucial.

Not Reviewing Lease Terms Thoroughly

Every term in a ground lease can have significant impacts. Pay close attention to clauses about lease duration, rent increases, responsibilities at lease expiration, and improvements. Ensure all terms are clear before signing.

Neglecting Professional Advice

Ground leases are complex agreements. Consulting real estate lawyers, brokers, and experienced investors can provide valuable insights and help identify hidden traps in the lease.

Underestimating Development and Management Costs

Tenants are typically responsible for property development and maintenance. Underestimating these costs can affect the financial viability of the lease agreement.

Failure to Negotiate

Initial lease agreements are often starting points for negotiations. Tenants who don’t negotiate may end up with unfavorable terms. Consulting with real estate professionals and staying informed about industry trends can help in securing better terms.

Careful planning and professional advice are key to avoiding common pitfalls in ground leasing.

Conclusion

Ground leases have the potential to unlock valuable opportunities for both investors and developers. By providing flexibility, cost-efficiency, and access to prime locations, ground leases enable businesses to thrive and developers to realize groundbreaking projects.

Ready to explore the potential of ground lease? Get in touch with our team today to discuss how ground leases can unlock opportunities for your business or development project.

In Case You Need an Office Space

Plug-and-play live/work/office. Private outdoor terrace with a fountain.

Stand-Alone Flex Building with Heavy Power

Frequently Asked Questions

Q1: What is the duration of a typical ground lease agreement?

The duration of a ground lease agreement can vary depending on the specific circumstances and negotiations between the parties involved. However, ground leases are commonly long-term agreements, often ranging from 30 to 99 years.

The extended duration allows the tenant to have ample time to develop and utilize the land effectively while providing the landowner with a stable and predictable income stream over an extended period.

Q2: Who is responsible for property maintenance in a ground lease?

In a ground lease, the responsibility for property maintenance is typically allocated to the tenant. The tenant is responsible for maintaining the leased land, including any improvements or structures built on it, throughout the lease term. This provision ensures that the property is well-maintained and preserved, protecting the interests of both the landowner and the tenant.

Q3: Can a ground lease be terminated before the agreed-upon duration?

Ground leases are legally binding contracts, and terminating them before the agreed-upon duration can be challenging. However, certain provisions may exist within the lease agreement that allow for early termination under specific circumstances, such as default or breach of contract by either party. It is crucial to carefully review the lease agreement and consult with legal professionals to understand the termination provisions and their implications.

Q4: Can a ground lease be extended beyond the initial lease term?

Yes, ground leases can be extended beyond the initial lease term through negotiation and mutual agreement between the landowner and tenant. Lease extension provisions are often included in the original lease agreement, outlining the process, terms, and conditions for extending the lease. The extension allows both parties to continue their beneficial relationship and reap the rewards of their investment in the property.

Q5: Can the rent in a ground lease increase over time?

Yes, the rent in a ground lease can increase over time. Rent escalation provisions are commonly included in ground lease agreements, allowing for periodic rent adjustments. These adjustments may be based on various factors, such as inflation, market conditions, or predetermined formulas outlined in the lease agreement. Rent escalation provisions ensure that the rent remains reflective of the current market value, providing a fair and equitable arrangement for both the landowner and the tenant.

Q6: Can a ground lease be financed or mortgaged?

Ground leases can be financed or mortgaged, although the process may differ from traditional property financing. In a ground lease, the land serves as the primary collateral, as the tenant usually owns the improvements on the property. Lenders may evaluate the creditworthiness of both the landowner and the tenant before approving financing for a ground lease. It is important to consult with financial and legal experts familiar with ground lease financing to navigate the complexities of the process.