San Francisco Office Market Overview

Executive Summary

San Francisco’s office market showed signs of recovery in Q3 2024, with leasing volumes hitting their highest since early 2022, driven by tech expansions in the AI sector. While downsizing has slowed, the vacancy rate remains the highest in the nation at 22.6%, a stark rise from 5.9% in 2019.

Despite slight rent declines, especially in downtown, challenges persist as tenants continue adjusting to hybrid work models. The market faces ongoing pressure from economic slowdowns and reduced demand, with negative rent growth expected in the year ahead.

Market Overview

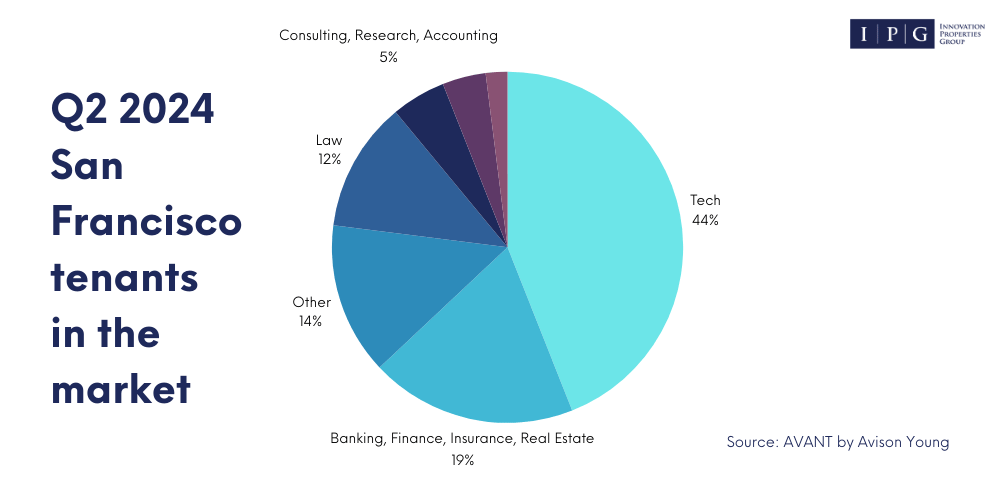

The San Francisco Bay Area remains a global leader in innovation, especially in the tech sector, with companies like Apple, Alphabet, NVIDIA, and Meta driving high economic growth and leading to some of the nation’s highest real estate prices. However, the tech-driven growth has also led to significant volatility, resulting in cycles of boom and bust in the real estate market.

The 2010s tech boom led to a surge in real estate demand, skyrocketing rents, and rapid development in downtown San Francisco. This was followed by a downturn starting in 2020, exacerbated by the pandemic, which saw many residents and businesses leave the city. The recent rise in interest rates has further pressured the local economy, leading to tech layoffs and a decline in real estate investments, particularly affecting downtown San Francisco.

While total employment has rebounded, the rise in flexible work arrangements raises questions about the true number of residents still living in the area.

Key Metrics – San Francisco Office Market

Vacancy Rate

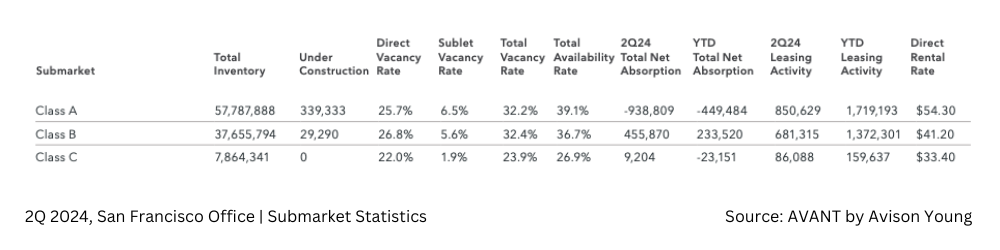

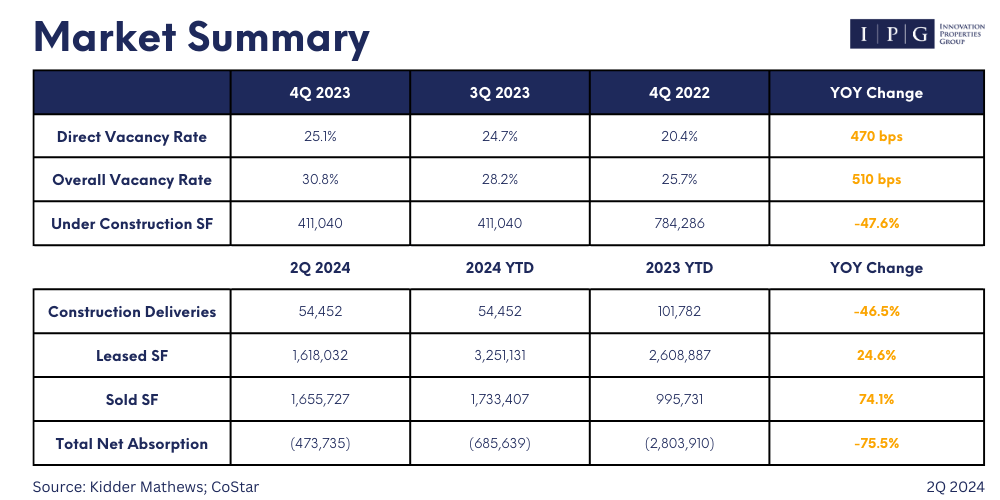

As of Q3 2024, San Francisco’s office market is grappling with a high vacancy rate of 22.6%, a substantial increase from previous years. The availability rate, including sublease space, has reached 26.3%, driven by the continued adjustments in the market to post-pandemic working patterns and economic pressures.

Rental Rates

The ongoing imbalance between supply and demand has driven office rental rates downward. Currently, the average asking rent in San Francisco is $53/SF, down 30% from its 2019 peak of $76/SF.

Although the pace of decline has slowed recently, landlords face challenges in pushing rates higher, particularly with 5.9% of the market’s inventory available for sublease. In response, property owners are focusing on maintaining face rates while offering attractive tenant improvement allowances and extended rent-free periods to secure longer lease terms.

Net Absorption

Net absorption in San Francisco has seen some stabilization, with a marginally negative figure in the first half of 2024, following more than -2 million SF of negative absorption in the prior three quarters. Despite these signs of improvement, the leasing market remains fragile, with activity levels still well below pre-pandemic norms.

Office Attendance

Office attendance has shown slight improvement, with key card activity data from Kastle Systems indicating a midweek peak at 55% of pre-pandemic levels. This reflects the broad acceptance of hybrid working models, with attendance dipping on Mondays and Fridays.

Inventory and New Deliveries

The market is also contending with a significant amount of sublease space, currently accounting for 11.5 million SF. Two-thirds of this sublet space remains vacant, contributing to the overall sluggishness in leasing activity.

Cap Rates

In the sales market, cap rates have risen, reflecting the broader economic uncertainty and investor caution. Market cap rates now stand at 6.5% and 8.7%, indicating the heightened risk and reduced appetite for investment in the current climate.

San Francisco’s office market is navigating a complex environment marked by high vacancy rates, declining rents, and cautious investor sentiment. The market’s recovery will depend on stabilizing these factors and adapting to the new realities of office space utilization and demand.

Market Drivers

As of Q3 2024, the San Francisco office market faces significant challenges, with the investment community concentrating on the need to recapitalize properties to reflect the sharp decline in market values.

San Francisco has been particularly affected by the shift to flexible working patterns, which has led to a substantial drop in demand for physical office space. Weak employment growth has further suppressed leasing activity, while rising interest rates have negatively impacted property values nationwide.

San Francisco’s situation is notable due to the rapid increase in office property prices leading up to the pandemic, with valuations often exceeding $1,000/SF. The current downturn has led to a market-wide reduction in office values, often by more than 50%. Appraisals and recent transactions indicate that many properties are now valued below the outstanding mortgage balance.

Distress is most evident in low-occupancy buildings and those with maturing loans needing refinancing. Many downtown Class A buildings are in default, with owners entering complex loan modification negotiations. Some properties have been sold through short sales or transferred to lenders via foreclosure or deed-in-lieu transactions.

The recapitalization process is expected to continue into 2025 as more properties enter default and require resolution.

Concluding Thoughts

The San Francisco office market is undergoing a period of significant transformation, driven by the ongoing shift toward flexible work models, economic pressures, and the rising cost of capital. While the recent uptick in leasing activity suggests some stabilization, the market faces continued challenges with high vacancy rates, declining rents, and substantial reductions in property values. As the city adapts to these changes, the real estate community must remain agile, leveraging innovative solutions to navigate this evolving landscape.

As we look ahead, the focus will likely remain on recapitalization efforts and finding new ways to utilize existing spaces effectively. The road to recovery may be gradual, but with careful planning and strategic investments, San Francisco’s office market has the potential to rebound and thrive once again.

Market Report Source: CoStar, Avison Young, Kidder Mathews

The information presented in this report is sourced from reliable entities and is believed to be accurate. However, IPG does not guarantee its completeness or correctness.

Explore More Insights

“San Francisco’s office market embodies resilience and reinvention. Success here requires a deep understanding of its unique dynamics and a vision for its future potential.”