Double Net Lease – Definition, How It Works and Comparisons

The concept of a double net lease (NN lease) is increasingly becoming popular among realtors and property owners.

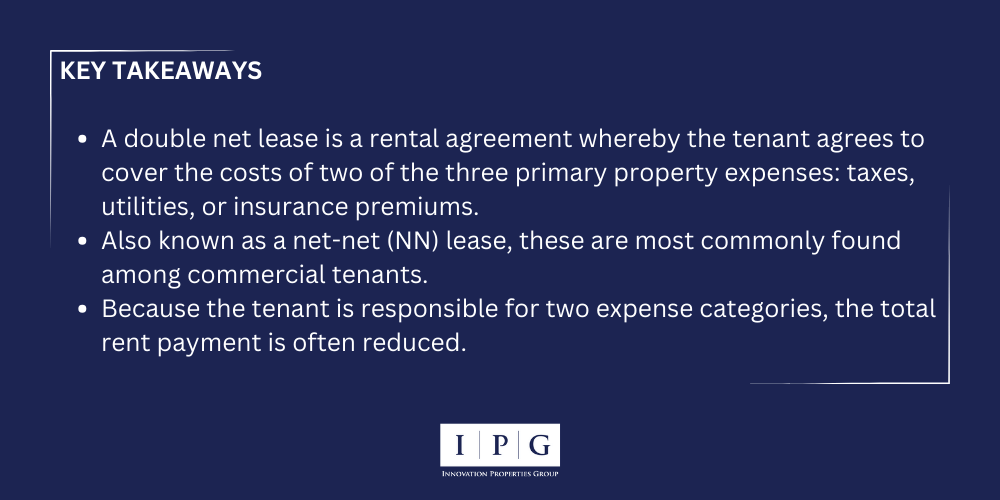

As the name suggests, this type of lease arrangement involves two different rental payments from the tenant. One for the base rent due to the landlord, and a second for some or all expenses related to maintaining and operating the property. These expenses may include taxes and insurance premiums.

This innovative solution gives landlords more stability in their cash flow, while providing tenants better control over their budget.

In this blog post, we’ll explore what is a double net lease and how they can be beneficial both to landlords renting out properties, as well as tenants who need short-term or long-term facilities.

Double Net vs Triple Net

While triple net leases are usually granted as low-risk for landlords, essentially restricted by the credit of the tenant, there are other leasing options with fluctuating degrees of risks that may be equally or even more suitable for landlords and their tenants.

Some types of net leases are double net leases – quite popular in commercial rentals. In the double net lease agreement, the resident pays:

- rent,

- property taxes,

- and insurance premiums.

The proprietor is responsible for all maintenance and repair costs.

Similarly, as in a single net lease, landlords prefer to have all of the additional payments made directly to them, so that they can manage the tax payments and insurance premiums.

In many big commercial and business properties for rent, the proprietor usually has multiple tenants in the same building, who lease spaces of different sizes.

In this case, each resident is assigned a proportionate amount of the tax and insurance premiums, based on the space percentage they occupy in the building.

We understand those lease agreements can be confusing in their complexity, but without getting to know the specific group of well-known lease types applied to some property, you can end up provided with fewer options as a tenant.

That is why I want to address the double net lease and better explain how it compares to other net lease types.

Double Net Lease Definition

NN lease is an agreement that requires the tenant to pay rent and some operating expenses such as property tax and insurance. This type of commercial real estate leasing allows the landlord to reduce their ownership costs by transferring some of the significant responsibilities of traditional leasing to the tenant.

The cost savings can be substantial for both parties, depending on how well the NN lease terms are negotiated. NN lease also tends to favor landlords, since most tenants prefer other forms of leasing where they have limited responsibility (e.g., triple net). Double net leases offer fewer rights and more risk for tenants, but can provide a great opportunity for them if managed correctly.

Advantages of Double Net Lease (For Landlords)

Unlocking the benefits of a double net lease can be advantageous for landlords. This unique leasing arrangement offers two primary benefits, providing a boost to their bottom line.

Firstly, the ability to retain more profit stands out as a key advantage. By shifting a portion of expenses onto tenants, landlords can enjoy higher net income, as their renters assume responsibility for certain costs. This allows landlords to keep a larger share of the rent as profit, facilitating financial growth and stability.

Secondly, a double net lease shields landlords from the impact of rising taxes and insurance rates. With these expenses falling under the tenants’ responsibilities, landlords are protected against the burden of increased costs, preserving their profitability even in the face of external price escalations.

Such protection ensures greater predictability and safeguards their investment against potential financial strains. Embracing a double net lease thus presents an attractive proposition for landlords seeking to optimize their profits while minimizing exposure to fluctuating expenses.

Double Net Lease Advantages For Tenants

Don’t be fooled by a common misconception that double net lease only offers benefits for landlords. It also has several appealing options for tenants too.

One key advantage is the potential for long-term stability. With a double net lease, tenants often have the opportunity to secure a more extended lease term, providing stability and minimizing the risk of sudden relocation.

These leases typically outline the tenant’s responsibilities for property taxes and insurance, which allows for predictable and manageable expenses. This clarity in financial obligations enables tenants to better plan and budget their costs.

Double net leases can provide tenants with the flexibility to customize and modify the leased space to suit their specific needs, giving them greater control over the design and functionality of the property.

Key Features of NN Lease

- Expense Sharing: In an NN lease, tenants usually take responsibility for property taxes and insurance, while landlords usually handle structural repairs and maintenance.

- Cost Predictability: Double net leases offer tenants predictable costs by clearly outlining their financial obligations (such as taxes and insurance), resulting in better budgeting and planning.

- Potential Savings: Compared to triple net leases, where tenants are responsible for additional expenses, double net leases can potentially result in cost savings for tenants.

- Flexibility for Customization: Depending on the lease terms, tenants may have the flexibility to modify and customize the leased space to suit their specific needs, subject to landlord approval.

- Lease Duration: Double net leases often come with longer lease terms, providing tenants with stability and reducing the need for frequent relocations.

- Negotiation Opportunities: Double net lease agreements can be negotiable, allowing tenants to discuss and potentially modify certain terms and conditions with the landlord.

- Investment Appeal: From an investor’s perspective, double net leases can be attractive due to the potential for stable income streams and shared expense responsibility with tenants.

How Double Net Lease Differs from Other Commercial Lease Types

The double net lease stands apart from other commercial lease types due to distinct differences in financial responsibilities and obligations.

Unlike a triple net lease where tenants are responsible for all expenses, including taxes, insurance, and maintenance, a double net lease places the burden of property taxes and insurance on the tenant while the landlord retains responsibility for structural repairs and maintenance. This key difference allows tenants to have a more predictable understanding of their financial obligations while providing landlords with some level of expense management.

Compared to a gross lease where the landlord covers all expenses, a double net lease offers greater cost transparency and potential cost savings for tenants.

Common Misconceptions About Double Net Leases

Clearing up misconceptions surrounding double net leases can help individuals make informed decisions.

One common misconception is that double net leases absolve landlords of all financial responsibilities. In reality, landlords still maintain certain obligations, such as structural repairs and maintenance costs.

Another misconception is that double net leases guarantee fixed rental income throughout the lease term. In truth, rental rates can fluctuate based on market conditions, and it is essential for both landlords and tenants to negotiate lease terms that align with prevailing market rates.

Some people mistakenly believe that double net leases are exclusively beneficial for landlords, neglecting the potential advantages they can offer tenants, such as long-term stability and predictable expenses.

Conclusion

Understanding the advantages, such as increased profit potential for landlords and long-term stability for tenants, highlights the appeal of this lease structure. However, it is important to consider the associated risks and challenges, including potential fluctuations in rental rates and misconceptions surrounding financial responsibilities.

By delving into key considerations like negotiation flexibility and customization options, informed decisions can be made to maximize the benefits of a double net lease. Whether you’re a landlord seeking stable income or a tenant aiming for cost predictability, embracing a double net lease can be a strategic choice.

Take the next step in your commercial leasing journey and explore the possibilities of a double net lease today. Reach out to us for expert guidance and personalized advice on finding the perfect double net lease arrangement for your needs.