Insights and Research

Get informed about the latest trends and news from the commercial real estate world.

Stay ahead with the latest research, insights, and articles from IPG. Our in-depth analysis provides the knowledge you need to make informed real estate decisions.

Insights

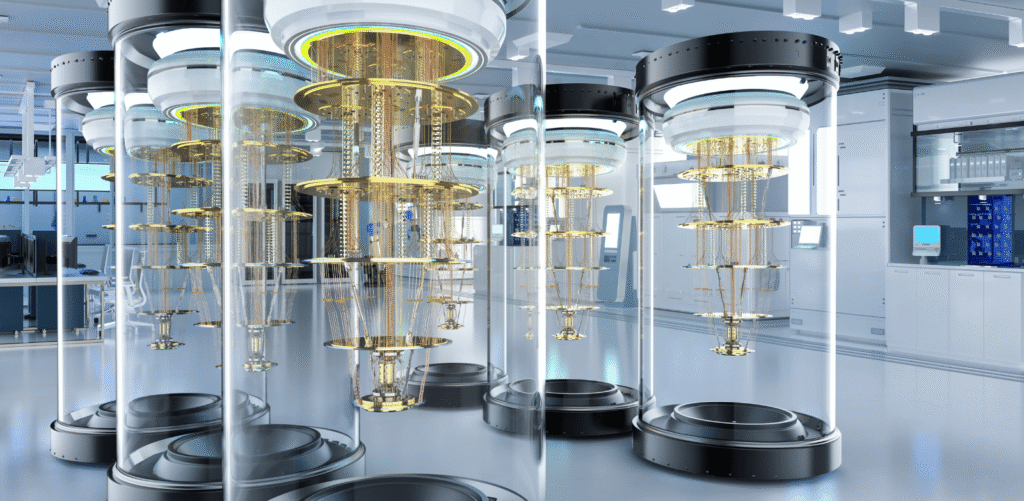

The Coming Quantum Boom

Insights