San Francisco Office Market Q1 2025

Record Vacancies and Signs of Strategic Repositioning

The first quarter of 2025 is offering a glimmer of hope for San Francisco’s office market. While the city continues to face historically high vacancy rates, signs of stabilization are emerging – driven by a shift in tenant activity and demand from the tech sector, particularly AI firms. Here’s what you need to know.

Market Overview

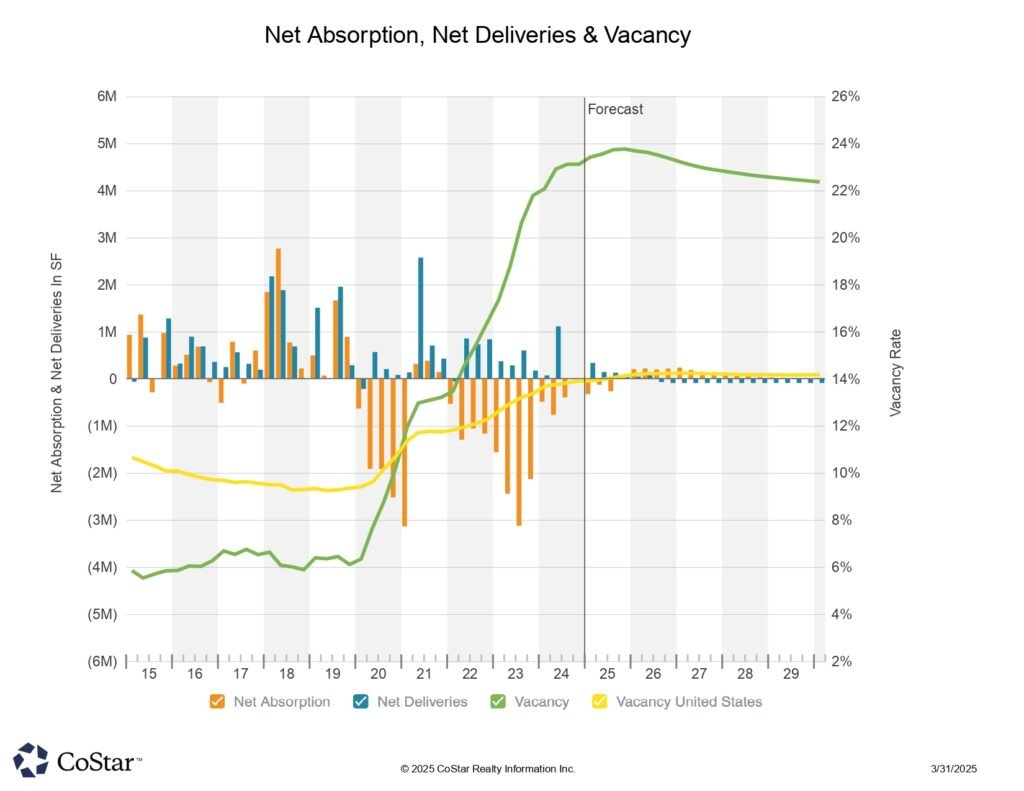

San Francisco closed Q1 2025 with a vacancy rate of 23.2%, the highest among all major U.S. office markets. That’s a stark contrast from 2019, when vacancy sat at just 5.9%. While the increase is substantial, the rate of vacancy growth has slowed, a sign that some of the pressure on the market may be easing.

Leasing Activity

Leasing volume over the past six months has been the highest since early 2022, signaling a rebound in activity. Much of this demand has come from AI-focused tech companies taking advantage of high-quality subleases left behind by prior tenants. Additionally, major leases from companies like Snowflake and Robinhood in late 2024 boosted activity, particularly in the northern San Francisco Peninsula.

Space Adjustments Slowing

The wave of lease terminations and space give-backs that characterized 2023 has notably slowed. Many companies have now finalized their hybrid space plans, and those that intended to downsize have largely already done so. This has helped stabilize the available space rate, including sublease options, which has remained flat for the past four quarters.

New Supply

Construction activity remains well below historical averages. Only 1.1 million square feet of new space was delivered in the past 12 months, with most new builds geared toward life sciences or build-to-suit projects. This limited supply may help balance the market longer term.

Rental Trends

Overall, market asking rents declined by 1.3% year-over-year in Q1. Downtown San Francisco has seen the most significant drop, with asking rents now roughly 30% below 2019 levels. While this sounds severe, the pace of rental declines has slowed, suggesting pricing may be finding a new floor.

Class A Vacancy

Top-tier assets (4- and 5-star buildings) are seeing 28.2% vacancy, contributing significantly to overall market softness. However, the consistent demand for quality space in desirable locations may help backstop future rent erosion.

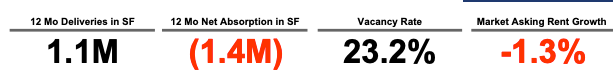

Key Metrics – San Francisco Office Market, Q1 2025

- Vacancy Rate: 23.2%

- Net Absorption (12 Mo.): (1.4 million SF)

- New Deliveries (12 Mo.): 1.1 million SF

- Market Rent Growth: -1.3%

- Class A Vacancy Rate: 28.2%

What This Means for Investors

While San Francisco’s office market still faces significant headwinds, there’s cautious optimism emerging. Leasing demand is picking up, construction is limited, and tenants are settling into new workplace strategies. For forward-thinking investors and occupiers, Q1 may mark a turning point – especially for those targeting stabilized assets or sublease opportunities at discounted rates.

For more in-depth data and analysis, please refer to CoStar’s full Q1 2025 San Francisco Office Market Report.