Is Ski Property a Good Investment?

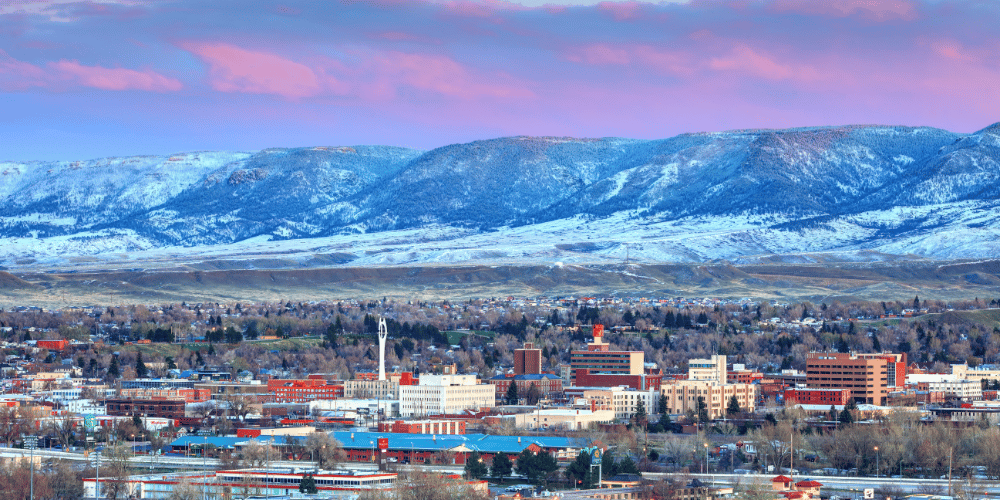

Ski properties have long been a favorite among real estate investors and vacation enthusiasts alike. With the allure of scenic mountain views, fresh powder, and the promise of seasonal rental income, it’s no wonder many are considering ski property investment.

But is ski property a good investment for you?

In this guide, we’ll explore the benefits, risks, and key factors to help you make an informed decision.

What Is a Ski Property Investment?

A ski property investment typically involves purchasing real estate near ski resorts, such as condos, chalets, or luxury homes.

These properties can serve as vacation homes, short-term rentals, or long-term investment assets. Unlike traditional real estate, ski properties attract seasonal renters who are eager to hit the slopes, making them a unique and potentially lucrative investment opportunity.

Benefits of Investing in Ski Property

1. Steady Rental Income

One of the biggest draws of ski property investment is the potential for steady rental income. During peak ski season, rental demand surges, allowing property owners to charge premium rates. This can result in high returns, especially in popular ski destinations.

2. Long-Term Appreciation

Ski properties in well-established resorts often see steady appreciation over time. Locations with a strong reputation and limited land availability, such as the French Alps or Colorado’s Rockies, tend to hold their value, providing a reliable long-term investment.

3. Personal Enjoyment

Beyond financial gains, ski properties offer personal benefits. Owners can use the property for their own vacations during off-peak periods, enjoying all the perks of mountain living while still generating income during peak times.

Key Factors to Consider Before Investing in Ski Property

Location, Location, Location

The success of a ski property investment largely depends on its location. Properties close to ski lifts, resort amenities, and year-round attractions are more likely to attract renters and appreciate in value. Popular destinations like Whistler, Aspen, and Jackson Hole remain in high demand due to their world-class ski facilities and vibrant local communities.

Seasonality and Rental Demand

It’s essential to understand the seasonal nature of ski property investment. While winter months bring peak rental demand, off-peak seasons may require strategies to maintain occupancy. Consider investing in areas that offer year-round activities like hiking, mountain biking, or festivals to keep rental income flowing.

Property Management

Managing a ski property, especially if you don’t live nearby, can be challenging. Reliable property management services can handle everything from guest check-ins to maintenance, ensuring your property stays in top condition and generating income. Be sure to factor in these costs when calculating potential returns.

Accessibility

Ease of access is a crucial consideration. Properties near airports, highways, and public transport hubs are more attractive to visitors, making them easier to rent out. Good accessibility can significantly enhance the appeal of your ski property investment.

Risks Associated with Ski Property Investment

1. Seasonal Dependence

Ski properties heavily rely on peak season rental income. Off-peak months can see a drop in occupancy, affecting overall returns.

2. Maintenance Costs

Harsh weather conditions can lead to higher maintenance costs for ski properties. Snow removal, heating, and upkeep for amenities can add up quickly.

3. Market Fluctuations

The value of ski properties can be affected by economic downturns, shifts in travel behavior, or changes in resort popularity. Investors should be prepared for market fluctuations and plan accordingly.

How to Maximize Your Ski Property Investment

Diversify Your Rental Strategy

Consider offering short-term rentals during peak ski season and long-term rentals in the off-season. This approach can help maintain a steady income stream throughout the year.

Focus on Year-Round Attractions

Invest in locations that have attractions beyond skiing. Properties near hiking trails, summer festivals, or lakes can attract visitors during off-peak months, boosting your rental income.

Consider Upgrades and Amenities

Modern, well-equipped properties attract higher-paying guests. Features like heated floors, hot tubs, fireplaces, and spacious kitchens can enhance the appeal of your ski property and justify premium rental rates.

Is Ski Property a Good Investment for You?

Ultimately, whether ski property investment is right for you depends on your financial goals, lifestyle, and risk tolerance. For investors looking to diversify their portfolio with a vacation home that generates rental income, ski properties can offer both enjoyment and profit. However, it’s essential to weigh the seasonal nature, maintenance costs, and market risks before diving in.

Conclusion

Investing in ski property can be a rewarding venture, offering the benefits of steady rental income, long-term appreciation, and personal enjoyment. However, it requires careful planning, especially considering factors like location, accessibility, and maintenance. By understanding the market and selecting properties that cater to year-round activities, investors can maximize their returns and enjoy a successful ski property investment.

Thinking about ski property investment? Contact us today to learn more about how you can find the perfect property and make the most of this unique opportunity.