Debt Service Coverage Ratio (DSCR) in Real Estate

DSCR tells you if a property’s income can cover its annual loan payments. It’s calculated as NOI ÷ annual debt service (principal + interest). Lenders use this number to size your loan and price risk—above their minimum, you’re in range; below it, proceeds shrink or the deal stalls.

In this post, we’ll cover what DSCR is, the formula, a quick example, and straightforward ways to improve it before you go to market.

What is the Debt Service Coverage Ratio?

Simply put, the DSCR measures a property’s ability to generate enough cash flow to cover its debt payments. It’s like a financial health check-up for your investment.

The debt service coverage ratio shows if a property can bring in enough income to meet its debt obligations, which includes both the principal and interest. You get this ratio by dividing the net operating income (NOI) by the total debt service.

Debt Service Coverage Ratio Formula

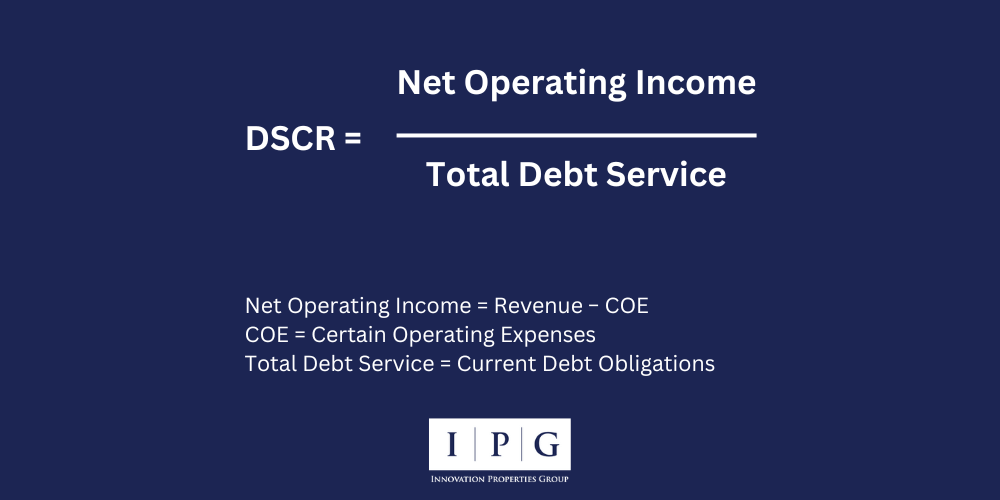

Now, let’s break down the Debt Service Coverage Ratio (DSCR) formula. It’s pretty straightforward once you get the hang of it. The DSCR formula helps you see if a property’s income can cover its debt payments.

The formula looks like this:

So, what goes into this formula? Let’s take a closer look at each component.

Net Operating Income (NOI)

Net Operating Income is essentially the revenue a property generates minus its operating expenses. Think of it as the money left over after covering all the day-to-day costs of running the property, but before paying taxes and interest. It’s similar to what you might hear called Earnings Before Interest and Taxes (EBIT).

To learn more about NOI click here.

Total Debt Service

Total Debt Service is the amount needed to cover all the property’s debt obligations. This includes both the principal and the interest payments on any loans.

To put it simply:

- Net Operating Income (NOI): Revenue – Operating Expenses (excluding taxes and interest)

- Total Debt Service: Principal + Interest Payments

By dividing the NOI by the Total Debt Service, you get a clear picture of whether the property is generating enough income to comfortably cover its debts. A higher DSCR means better financial health, while a lower DSCR might indicate potential issues with debt repayment.

How to Calculate Debt Service Coverage Ratio

Calculating the Debt Service Coverage Ratio (DSCR) is straightforward if you follow the right steps. Let’s break it down into a step-by-step guide so you can easily figure out the DSCR for any property.

Step-by-Step Guide on Calculating DSCR

- Calculate Net Operating Income (NOI): Start by figuring out the property’s revenue and subtracting the operating expenses (excluding taxes and interest). This gives you the NOI.

- Determine Total Debt Service: Add up all the property’s debt payments, including both principal and interest.

- Apply the Formula: Divide the NOI by the Total Debt Service.

Debt Service Coverage Ratio Example

Let’s go through a practical example to illustrate how to calculate the Debt Service Coverage Ratio.

Step-by-Step Calculation

Imagine you have a property with the following financials:

- Annual Revenue: $200,000

- Operating Expenses (excluding taxes and interest): $50,000

- Annual Principal and Interest Payments: $100,000

In this example, the DSCR is 1.5, indicating that the property generates 1.5 times the income needed to cover its debt payments, which is a sign of good financial health.

By avoiding common mistakes and following these steps, you can accurately calculate the DSCR and assess the financial viability of your real estate investments.

What is the Debt Service Coverage Ratio Used For?

The Debt Service Coverage Ratio (DSCR) is a powerful tool in the world of real estate. It’s used for a variety of critical applications that help investors and lenders make informed decisions. Let’s explore how DSCR is applied and why it’s so important.

Assessing Investment Viability

When evaluating potential investments, DSCR plays a crucial role. Investors use the debt service coverage ratio to gauge the financial health of a property. A higher DSCR means the property generates sufficient income to cover its debt obligations comfortably, making it a safer and more attractive investment. Essentially, it tells investors whether there’s enough cash flow left over after paying debts to provide returns.

Lender’s Perspective

From a lender’s perspective, DSCR is one of the key metrics in loan approval processes. Lenders use the ratio to assess a borrower’s ability to meet interest and principal payment obligations. A higher DSCR indicates that the borrower is more likely to repay the loan without defaulting, which reduces the lender’s risk. This makes DSCR a crucial factor in determining whether to approve a loan and under what terms.

Other Uses of DSCR

Loans

Lenders rely heavily on DSCR to evaluate the creditworthiness of a business or property. It serves as a primary measure of the borrower’s ability to meet debt obligations, ensuring that the income generated is sufficient to cover loan payments.

Investment

Shareholders, potential investors, and buyers use DSCR to assess the financial health of a business. It gives them a clear picture of how much income remains after covering debts, which can be used for dividends or reinvestment. This makes DSCR an essential metric for evaluating the profitability and sustainability of an investment.

Strategic Planning

Entrepreneurs and business owners use DSCR for strategic planning. It helps them understand their capacity for growth and their ability to secure additional financing. By evaluating their DSCR, they can make informed decisions about expanding operations, investing in new projects, or restructuring debt.

Debt Service Coverage Ratio – FAQs

What is a Good Debt Service Coverage Ratio?

A good DSCR typically falls above 1.25. This means the property generates 25% more income than is needed to cover its debt payments, providing a comfortable cushion for unexpected expenses. A DSCR below 1.0 indicates that the property isn’t generating enough income to cover its debt obligations, which is a red flag for investors and lenders. In general:

- DSCR > 1.25: Strong financial health, lower risk.

- DSCR = 1.0: Just breaking even, higher risk.

- DSCR < 1.0: Insufficient income to cover debt, very high risk.

How Often Should DSCR Be Calculated?

It’s a good practice to calculate the DSCR regularly to keep tabs on the financial health of your investment. For most properties, an annual calculation is sufficient. However, if your property’s income or expenses fluctuate significantly, you might want to assess the DSCR quarterly or semi-annually. Regular monitoring helps you catch potential issues early and make informed decisions to maintain financial stability.

Can DSCR Be Improved?

Yes, DSCR can definitely be improved. Here are a few strategies to boost a low DSCR:

- Increase Income: Raise rents, improve occupancy rates, or add additional revenue streams.

- Reduce Operating Expenses: Cut unnecessary costs, negotiate better rates with service providers, or invest in energy-efficient upgrades.

- Refinance Debt: Look for better loan terms with lower interest rates or extend the loan term to reduce monthly debt service.

- Restructure Leases: If applicable, restructure leases to increase NOI.

Improving your DSCR not only enhances the financial health of your property but also makes it more attractive to lenders and investors.

By understanding and effectively managing your DSCR, you can ensure the long-term success and profitability of your real estate investments.

If you have more questions or need personalized advice, don’t hesitate to reach out to our experts