Why Invest in Wine Country Real Estate?

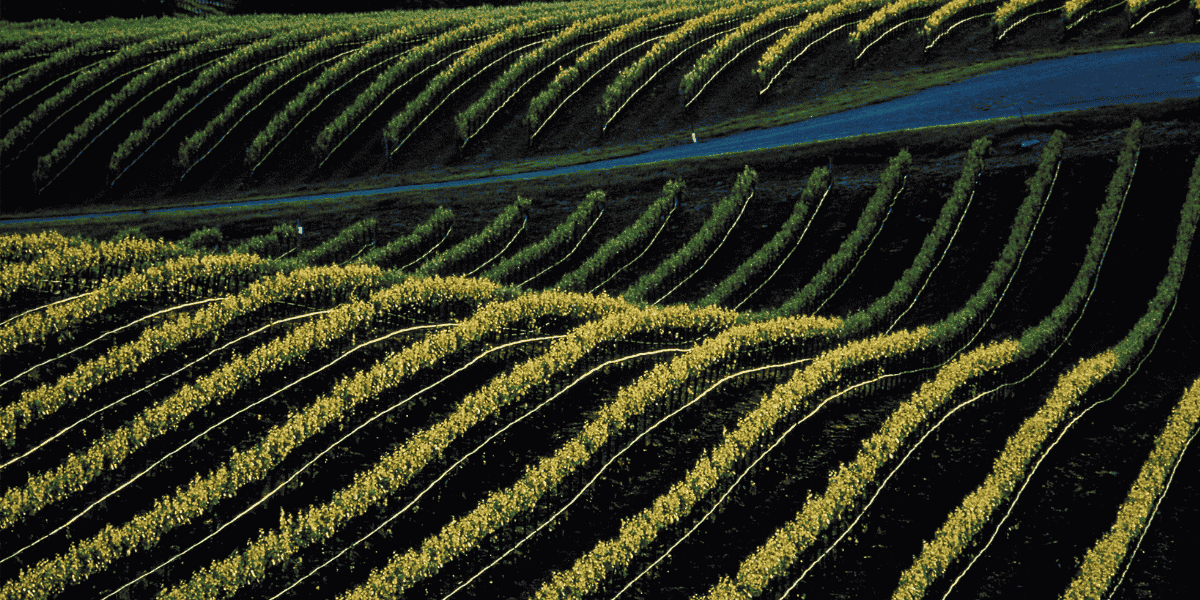

California’s wine country is more than a postcard-perfect destination – it’s a dynamic and evolving real estate market that blends agriculture, lifestyle, and long-term value. Whether you’re a seasoned investor or a buyer exploring something beyond traditional commercial assets, vineyard real estate offers a rare combination of stability, prestige, and potential.

I’ll walk you through the fundamentals of investing in wine country real estate – what makes it attractive, what to consider, and why now may be the right time to explore opportunities in California’s most iconic AVAs (American Viticultural Areas).

What Is Wine Country Real Estate?

Wine country real estate refers to land and properties located in viticultural regions – typically designed for grape cultivation, winemaking, hospitality, or residential lifestyle. This includes:

- Vineyards: Working agricultural land used for growing wine grapes

- Wineries: Facilities where wine is produced, often with tasting rooms or event spaces

- Estate Properties: Homes or compounds set on vineyard land, sometimes with production or hospitality elements

In California, the most well-known wine regions include Napa Valley, Sonoma County, Paso Robles, Santa Barbara, San Diego County, and parts of Mendocino and Monterey.

Why Investors Are Paying Attention

1. Tangible Assets With Lasting Value

Unlike other real estate categories, vineyards are land-backed, income-generating agricultural assets. With proper management and location, they can appreciate in value while producing a steady yield from grape sales or wine production.

In premium regions like Napa and Sonoma, vineyard values can range from $150,000 to over $500,000 per acre, depending on AVA designation, soil, slope, water rights, and vine age.

2. Diversification of Portfolio

Wine country real estate behaves differently from urban commercial markets. It’s less correlated with stock market volatility and offers a way to diversify into agricultural and lifestyle-based investments—particularly appealing to high-net-worth individuals, family offices, and institutional buyers.

3. Lifestyle Meets Legacy

Many investors aren’t just looking at ROI—they’re buying into the lifestyle. A vineyard estate isn’t just a property; it’s a chance to build something lasting. Some buyers want to operate a winery; others lease vines to producers or partner with wine brands.

It’s also common to pass vineyard holdings to the next generation. These estates often serve as multi-generational assets, blending personal enjoyment with long-term planning.

4. Supply is Limited

Prime vineyard land is finite. AVAs are carefully regulated, and much of the best terroir in California has already been planted or preserved. Unlike commercial real estate, you can’t just “build more” in premium wine country.

This natural scarcity drives long-term appreciation and protects against oversupply.

What to Consider Before You Invest

1. Due Diligence is Everything

Before purchasing a vineyard or winery, you’ll need to review:

- Soil reports and AVA classification

- Water access and usage rights

- Zoning, licensing, and production regulations

- Infrastructure: vines, equipment, facilities

- Business performance (if existing operation)

That’s where our team at IPG comes in—we help buyers evaluate not just the land, but the opportunity behind it.

2. Operating vs. Passive Ownership

Some buyers want to operate their own label; others prefer to lease vines to local winemakers or contract out production. Your level of involvement will influence the type of property, staffing needs, and return model.

3. Climate & Sustainability

Climate change is reshaping wine regions. Some traditional areas are becoming warmer and drier, while others (like higher elevation sites) are gaining traction. We help clients assess long-term environmental risks and opportunities.

Why California?

California produces over 80% of all U.S. wine and is home to some of the world’s most valuable vineyard real estate. Global demand for California wines, limited supply of premium land, and strong tourism appeal all contribute to a healthy, resilient market.

Whether you’re buying in Napa for prestige, Sonoma for balance, or Paso Robles for value, California remains the epicenter of wine real estate in the U.S.

Final Thoughts

Investing in wine country real estate isn’t just about acquiring land—it’s about securing a long-term asset with meaning, beauty, and income potential. At IPG, we combine real estate expertise with hands-on understanding of the wine business to help you navigate each step with confidence.

Ready to explore vineyard and winery investment opportunities in California?

Let’s talk. Our team can help you find, evaluate, and acquire premium wine country real estate.