What Is Pro Rata Share in Commercial Real Estate?

When it comes to understanding pro rata share, simplicity is key.

This concept is a fundamental principle in various fields, ensuring fair and proportional distribution. Whether it’s in commercial real estate, partnerships, or investment, pro rata share determines each party’s rightful portion based on their ownership percentage.

Let’s explore how this principle is used in different contexts and uncover its significance through practical examples.

What is Pro Rata Share?

Pro rata share is a fundamental concept in various fields, ensuring fair and proportional distribution.

Pro rata meaning: it originates from Latin and means “in proportion”. This principle is used to allocate resources, such as assets, capital, or profits, based on ownership percentages or stakes Pro rata share is particularly useful when the exact value of something cannot be easily or precisely measured, but it can be assigned a proportionate value when compared to something else.

Pro rata share is a proportionate allocation or distribution of resources, ensuring that each party receives their fair share based on their ownership percentage.

Understanding pro rata share is essential for ensuring fairness, efficiency, transparency, and flexibility in the allocation of resources. By applying this principle, resources are distributed in a way that is proportional to each party’s share or interest, maintaining trust and integrity in any system that relies on the allocation of resources.

In Commercial Real Estate

In the context of commercial real estate, pro rata share is the method used to figure out each tenant’s portion of the total expenses for a building. This method determines the specific percentage of the expenses that a tenant is responsible for, which is typically outlined in their lease agreement.

Pro rata share is generally represented as a percentage. In the CRE sector, it is often used interchangeably to describe the division and allocation of these expenses.

Essentially, to calculate their pro rata share, a tenant will divide the square footage they rent by the building’s total rentable square footage. Sometimes, the lease will already specify the tenant’s pro rata share as a set percentage.

How Does Pro Rata Work?

As we have stated in previous paragraphs, pro-rata literally means dividing something to make up a whole. That doesn’t mean that all parts need to be equal, but it is true that each piece is given value in proportion to something else.

Pro-rata share is particularly useful when the exact value of something can’t be easily or precisely determined, but can easily be assigned a proportion value when compared to something else.

Examples of pro-rata being used include the division of monthly adjusted loan payments. However, the number of monthly payments is allocated between the principal payment and the interest paid for the loan change each month as the loan gets paid off.

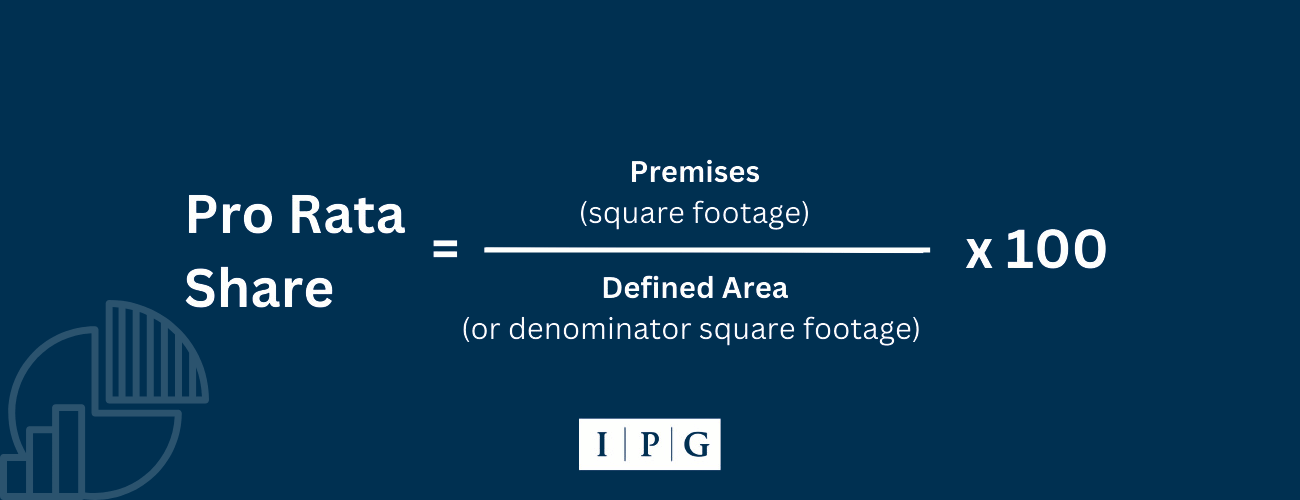

Calculating Pro Rata Share of Expenses

To calculate a tenant’s Pro Rata Share of expenses, follow these steps:

- Start by finding the tenant’s leased square footage, as specified in their lease.

- Next, identify the Defined Area of the building, which is the total space used for Pro Rata Share calculations. This could be either the Gross Leasable Area (GLA), which includes all leasable space in the building, or the Gross Lease Occupied Area (GLOA), which only counts occupied space. GLA calculations generally result in a lower expense share for the tenant, while GLOA calculations tend to favor the landlord by including only leased and occupied spaces in the Defined Area.

- Divide the tenant’s leased square footage by the Defined Area, as described in the lease, to find the tenant’s space occupancy percentage.

- Finally, multiply this percentage by 100 to determine the tenant’s Pro Rata Share of space and associated expenses.

Tip: Pro rata can be expressed as a percentage, such as a shareholder owning 10% of the company’s stock, or as a quantity, such as owning 100,000 out of the company’s 1 million shares.

FAQs

What does “pro rata” mean?

It’s Latin for “in proportion.” In CRE, it’s how shared costs are divided based on each tenant’s share of the property.

How do I calculate my pro rata share?

Use (Tenant RSF ÷ Denominator RSF) × 100. Then multiply that percentage by the expense pool (CAM/OpEx/taxes) to estimate your cost.

Is pro rata share the same as load factor?

No. Load factor converts usable area to rentable area by allocating common areas. Pro rata share allocates expenses based on RSF ÷ denominator.

Precision is Crucial

Maintaining precision is essential when calculating Pro Rata Share in commercial real estate. Inaccuracies can lead to either overestimation or underestimation of a tenant’s share, affecting multiple expenses. This might result in the tenant significantly overpaying or underpaying their expense reimbursements. Such errors often remain undetected until a detailed audit is conducted by either the tenant or the landlord.

Overpayments can strain the tenant’s cash flow, and rectifying them can be a lengthy process. Conversely, underpayments can lead to a substantial financial burden for the tenant if the landlord discovers the discrepancy and demands compensation for the shortfall, impacting the tenant’s financial stability. To prevent such issues, it’s crucial to thoroughly review the lease for clauses affecting Pro Rata Share calculations and ensure accurate computation from the start.

Keep in mind…

In commercial real estate, it’s important to note that the Defined Area used for Pro Rata Share calculations can sometimes be limited to just a part of the building, or it might encompass the total square footage of multiple buildings.

This means that tenants in different types of spaces, like retail or office units, could have varying Defined Areas, affecting their Pro Rata Share calculations differently. It’s crucial to review the lease thoroughly to understand how the Defined Area is determined.