San Francisco Office Vacancy Rate: Trends, Challenges, Opportunities

San Francisco’s office market, long grappling with the impacts of remote work and economic uncertainty, has ended 2024 on a cautiously optimistic note.

For the first time in years, leasing activity surged, vacancy rates stabilized, and analysts predict the city might be on the brink of a slow but steady recovery by mid-2025.

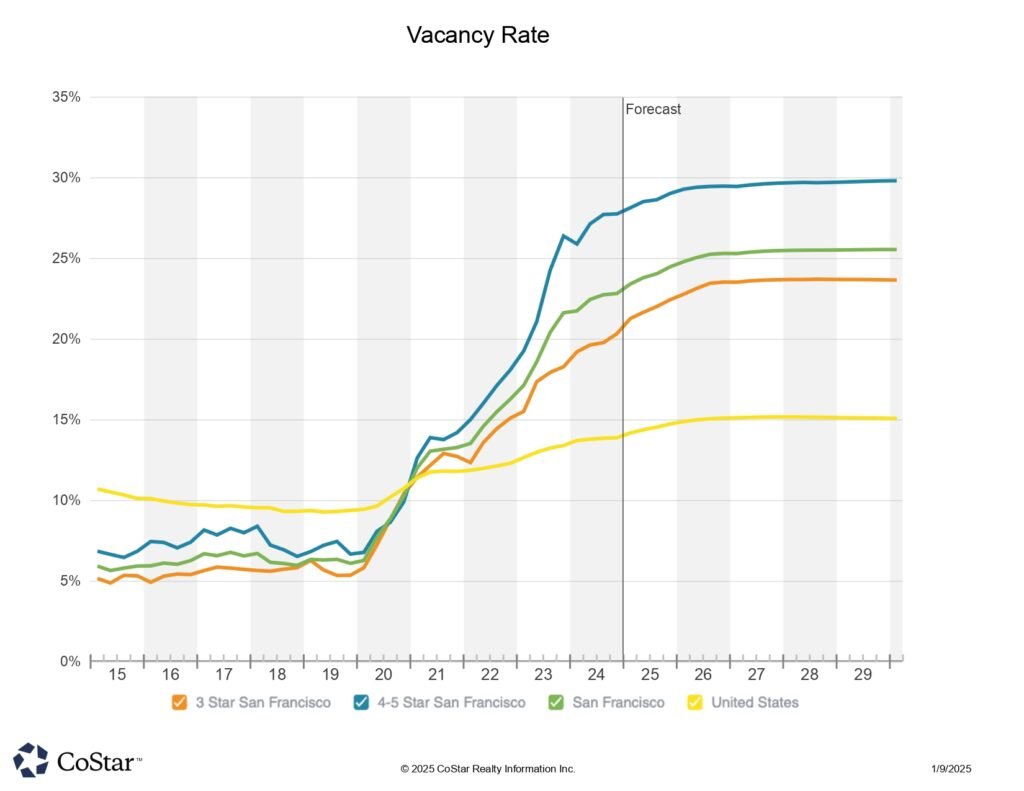

In Q4 2024, office leasing activity reached over 2.2 million square feet, a significant jump from 1.7 million square feet in the previous quarter and the highest quarterly volume since 2019, according to a Savills report. Vacancy rates, which had climbed to a record-breaking 36.9% earlier in the year, ticked down to 36.6%, signaling a possible plateau in the city’s long-standing office space struggles.

CBRE projects that office leasing in San Francisco will total 7.6 million square feet for 2024—a 20% increase compared to 2023 and the best annual performance since 2019’s pre-pandemic boom. While the vacancy rate remains historically high, these numbers suggest that the city’s office market, though far from its peak, may be carving out a path toward stabilization.

A Sign of Gradual Rebound

San Francisco’s office market is cautiously inching toward recovery, with analysts predicting that 2025 will provide additional momentum. Colin Yasukochi, executive director of CBRE’s Tech Insights Center, anticipates an “uneven and segmented” recovery process in the coming quarters. While the vacancy rate may fluctuate, this period of instability is seen as part of the bottoming-out process. According to Yasukochi, “an extended period of growth” will be required to rebalance supply and demand in the market.

Vacancy Challenges Persist

Despite signs of recovery, office vacancies in San Francisco may rise again in early 2025, according to JLL. The market continues to absorb excess space, especially as large companies exit leases. Alexander Quinn, senior director of Northern California research at JLL, predicts that a more sustained turnaround could materialize later in the year, possibly by the second quarter. Large blocks of available space, such as X Corp.’s former headquarters on Market Street, highlight the ongoing struggle to fill vacant offices.

Tenant Adaptations: Lyft’s HQ Lease Renewal

One recent deal exemplifies the current state of the market. Ride-hailing giant Lyft renewed its San Francisco headquarters lease at 185 Berry Street for another decade but significantly reduced its footprint. Originally leasing 335,000 square feet, Lyft has downsized to 170,000 square feet, shedding 165,000 square feet of space. This adjustment reflects a broader trend of companies recalibrating their office needs to align with hybrid work models.

Lyft’s decision underscores a long-term commitment to San Francisco, even as it navigates challenges such as seeking a $100M tax refund from the city over business tax disputes. Meanwhile, the remaining 326,000 square feet at the 185 Berry office campus is actively being marketed, reflecting the broader leasing landscape in the city.

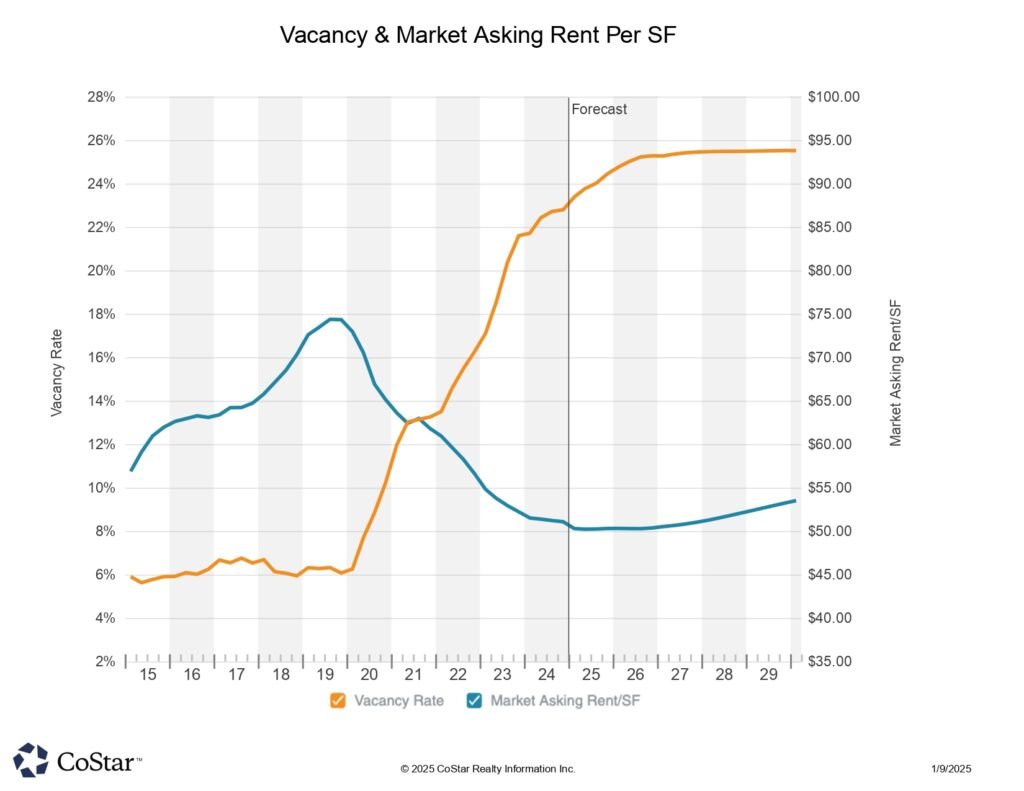

Leasing Trends and Rental Rates

Renewal deals dominated leasing activity in the fourth quarter of 2024, with the office availability rate holding steady at 36.6%, according to Savills. Average asking rental rates for office space dipped slightly, decreasing to $67.84 per square foot from $68.22 in Q3. While the decline is modest, it reflects ongoing pricing pressure as landlords compete to attract tenants in a high-vacancy market.

The Path Forward

San Francisco’s office market recovery will likely be slow and incremental, requiring patience and strategic planning from landlords and tenants alike. With large companies continuing to downsize, and space from vacated leases still on the market, the balance between supply and demand remains delicate. Analysts agree that a meaningful rebound may take years to fully materialize.

For tenants looking to secure office space, this transitional period presents opportunities to renegotiate leases or lock in favorable terms. For landlords, creative solutions and targeted investments will be crucial to reactivating vacant spaces and attracting new tenants.

San Francisco’s office market has weathered significant challenges, but with cautious optimism for 2025, the city is slowly positioning itself for a more stable and vibrant future.