Leveraged Lease Explained

In today’s dynamic commercial real estate landscape, understanding different lease structures is essential for businesses seeking flexible financing options. One such structure that offers unique advantages is the leveraged lease.

In this blog post, we will delve into the intricacies of leveraged leases and explore their significance in commercial real estate transactions.

What is a Leveraged Lease?

Defining Leveraged Lease and its Meaning

At its core, a leveraged lease is a financial arrangement that combines debt and equity to fund the acquisition of an asset, typically used in the context of commercial real estate.

It involves three main parties: the lessor (the owner of the asset), the lessee (the company using the asset), and the lender (providing debt financing).

Understanding the Structure and Components of a Leveraged Lease

A leveraged lease consists of several key components.

First, the lessor acquires the asset and forms a partnership with the lessee. The partnership then leases the asset to the lessee, who operates and benefits from its use. Simultaneously, the lender provides the necessary debt financing to support the acquisition of the asset.

Leveraged Leasing in Easy Words

In simple terms, a leveraged lease combines borrowed money and equity to acquire an asset.

It allows businesses to access larger capital amounts, benefit from potential tax advantages, and retain a stake in ownership. Leveraged leases are suitable for long-term financing needs and offer flexibility in structuring financial arrangements.

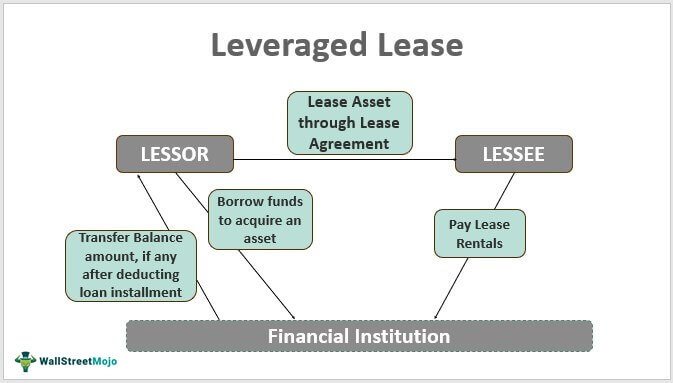

Visualizing the Leveraged Lease Structure: Diagram

To illustrate the structure of a leveraged lease, let’s consider a scenario involving a commercial property. Please refer to the diagram below:

In this diagram, you can see how the lessor, lessee, and lender interact within the leveraged lease framework, highlighting the flow of financing and asset utilization.

Leveraged Lease vs. Operating Lease

Differentiating Leveraged Lease and Operating Lease

While leveraged leases and operating leases both involve the use of assets in exchange for rental payments, there are significant differences between the two.

An operating lease is a traditional lease agreement where the lessee pays periodic rental payments to the lessor for the use of an asset. The lessor retains ownership of the asset, and the lessee does not typically assume the risks and benefits of ownership.

On the other hand, a leveraged lease incorporates debt financing, allowing the lessee to have a stake in the ownership of the asset. This arrangement gives the lessee certain tax advantages and allows for greater flexibility in financing options.

Financial and Operational Implications

Operating leases are often used for shorter durations and have lower upfront costs, making them suitable for businesses that require flexibility and regularly updated equipment. In contrast, leveraged leases are more long-term in nature and involve higher financial commitments due to the incorporation of debt financing.

Leveraged leases can provide various advantages for lessees, such as potential tax benefits, increased borrowing capacity, and the ability to retain a portion of the asset’s residual value. These factors make leveraged leases attractive for businesses aiming to optimize their capital structure and gain ownership benefits.

How Leveraged Leases Work

Key Feature of Leveraged Leasing

The primary feature of leveraged leasing is the combination of debt and equity to acquire an asset. This structure allows lessees to leverage their capital by using borrowed funds, thereby reducing the initial cash outlay required to acquire the asset.

Leveraged Lease Formula

To determine the financial terms of a leveraged lease, a formula is often used.

The formula calculates the rental payments and the debt service coverage ratio, which helps assess the lessee’s ability to meet the debt obligations. The specific formula may vary depending on the terms of the lease and the asset involved.

Example of a Leveraged Lease

Consider a company that wants to acquire a commercial property valued at $5 million. Through a leveraged lease, the company secures debt financing for $4 million (80% of the asset value) and contributes $1 million (20%) as equity. The debt is repaid through rental payments made by the lessee over the lease term.

This example showcases how leveraging debt enables businesses to access larger capital amounts and benefit from the cash flow generated by the asset while retaining partial ownership.

Leveraged Lease Advantages and Disadvantages

Advantages of Leveraged Leases

Leveraged leases offer several advantages for businesses seeking financing options:

- Increased Borrowing Capacity: Leveraged leases allow businesses to acquire assets that would otherwise be financially out of reach. By combining equity and debt financing, lessees can access larger capital amounts and expand their operations.

- Potential Tax Benefits: Leveraged leases can provide tax advantages, such as deducting both the rental payments and the interest portion of the debt from taxable income. This can result in reduced tax liabilities and improved cash flow for the lessee.

- Retained Residual Value: Unlike operating leases, where the lessor retains all ownership benefits, leveraged leases enable lessees to retain a portion of the asset’s residual value. This means that at the end of the lease term, the lessee may have the option to purchase the asset at a predetermined price.

Disadvantages of Leveraged Leases

While leveraged leases offer benefits, it’s important to consider potential drawbacks:

- Higher Risks: Leveraged leases involve borrowing substantial funds, which increases financial risks. If the lessee faces financial difficulties or the asset’s value depreciates significantly, it could lead to financial strain or default on loan obligations.

- Financial Obligations: The lessee is responsible for both rental payments and loan repayments. This dual financial commitment can place a significant burden on the lessee’s cash flow and financial resources.

Leveraged Lease Tax Treatment

From a tax perspective, leveraged leases may offer advantages depending on the jurisdiction and applicable tax laws. It’s essential for businesses considering leveraged leases to consult with tax professionals to fully understand the tax treatment and potential benefits specific to their circumstances.

Why Leveraged Leasing is Not Suitable for Long-Term Use

While leveraged leases can be beneficial in certain situations, they may not be ideal for long-term use due to the following reasons:

- Higher Total Cost: The inclusion of debt financing in leveraged leases increases the overall cost of acquiring the asset. Over an extended period, the interest payments on the borrowed funds can significantly impact the total cost of the lease.

- Limited Flexibility: Leveraged leases often involve long-term commitments, which can restrict the lessee’s flexibility to adapt to changing business needs or market conditions. Modifying or terminating the lease prematurely may come with substantial penalties or financial consequences.

In conclusion, leveraged leases can be a powerful tool for businesses seeking to acquire assets while leveraging debt financing. However, it’s crucial to carefully assess the advantages and disadvantages, consider the specific financial circumstances, and evaluate the long-term feasibility before committing to a leveraged lease.

Remember, when considering leveraged leases or any financial arrangement, consulting with professionals and seeking expert advice tailored to your specific circumstances is crucial to ensure the best possible outcomes.