Understanding Internal Rate of Return (IRR) in Commercial Real Estate

When analyzing potential investments in commercial real estate, it’s crucial to have clear, reliable metrics to guide decision-making. One of the most widely used tools for evaluating investment performance is the internal rate of return (IRR). But what exactly is IRR, and why does it matter in commercial real estate?

This blog breaks down the concept of IRR, explains how it works, and explores why investors rely on it when comparing real estate opportunities.

What Is Internal Rate of Return (IRR)?

IRR, or internal rate of return, is a financial metric used to estimate the profitability of potential investments. It represents the annualized rate of return at which the net present value (NPV) of all cash flows from a project equals zero.

In simple terms, IRR answers the question: “What rate of return will this investment generate over its life?” It’s expressed as a percentage and allows investors to compare different investment opportunities on the same basis, regardless of project size or type.

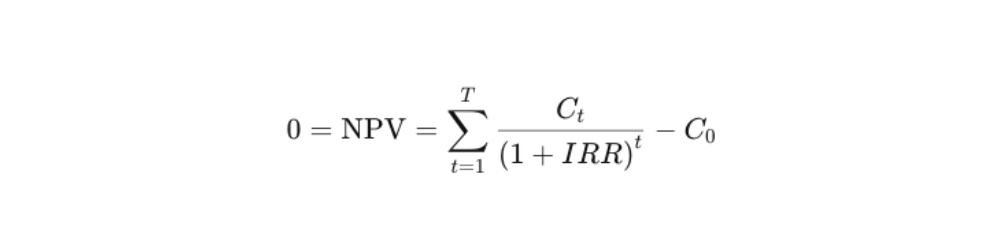

The formula for IRR is based on the same principles as NPV calculations:

In this formula:

- Ct = cash flow at time t

- C0 = initial investment

- t = total number of time periods

- IRR = internal rate of return

By solving this equation, you find the discount rate (IRR) that makes the sum of discounted future cash flows equal to the initial investment.

Why Does IRR Matter in Commercial Real Estate?

The internal rate of return is a powerful tool in commercial real estate because it gives investors a standardized way to evaluate different projects. Whether you’re considering an office building, a retail center, or an industrial warehouse, IRR helps answer: “Is this deal worth it?”

Key Benefits of Using IRR:

1. Comparable Across Investment Types

One of IRR’s greatest strengths is that it’s uniform across investment types. You can use IRR to compare projects of different sizes, timelines, or structures—whether it’s a multifamily property or a Class A office building.

2. Considers the Time Value of Money

Unlike simple return measures, IRR accounts for the fact that money today is worth more than money tomorrow. It discounts future cash flows, giving you a more realistic picture of an investment’s profitability.

3. Decision-Making Tool

Generally, the higher the IRR, the more attractive the investment. Investors often use IRR to rank multiple opportunities, especially when capital is limited.

What’s a “Good” IRR in Commercial Real Estate?

What qualifies as a “good” IRR depends on market conditions, property type, and investment goals. However, a common rule of thumb is that IRRs of 12% or higher are considered strong for commercial real estate, though some investors may accept lower IRRs for core, low-risk properties.

Keep in mind that IRR is not a dollar amount; it’s a rate of return. A project with a 15% IRR doesn’t mean you’ll earn 15% profit on your initial investment—it means the cash flows, discounted at 15%, equal your original outlay.

Limitations of Internal Rate of Return

While IRR is a valuable tool, it’s important to understand its limitations:

- Assumes reinvestment at the same rate: IRR assumes future cash flows can be reinvested at the same rate as the IRR itself, which may not reflect real-world market conditions.

Multiple IRRs possible: Certain projects with fluctuating cash flows may have more than one IRR, leading to confusion. - Not a standalone metric: IRR should be used alongside other financial metrics like NPV, cash-on-cash return, and equity multiple for a fuller picture.

How Investors Use IRR in Real Estate

Investors use the internal rate of return during the underwriting phase of a deal to project potential returns. It’s often included in investment memorandums, pitch decks, and pro forma models.

For example, let’s say you’re evaluating two office properties:

- Property A: Projected IRR = 14%

- Property B: Projected IRR = 10%

All else equal, Property A appears to be the better investment. But other factors—risk, location, tenant quality—must also be weighed before making a decision.

The Bottom Line

The internal rate of return (IRR) is a foundational metric in commercial real estate investment analysis. It provides a standardized, time-value-adjusted way to estimate an investment’s return potential, making it easier to compare projects and make informed decisions.

However, like all financial tools, IRR works best when used in context and alongside other metrics. A high IRR doesn’t guarantee success, and a low IRR doesn’t necessarily mean a bad deal—it’s one piece of a much larger investment puzzle.

At IPG, we help clients navigate the complexities of commercial real estate investment. Whether you’re evaluating a new opportunity or reassessing your portfolio, understanding IRR is key to making smarter, more confident decisions.