The Coming Quantum Boom

Quantum computing isn’t a “faster chip” story; it’s a rewrite of how information is processed.

Think optimization, materials discovery, drug design, cybersecurity and finance—problems classical machines struggle with—suddenly becoming tractable. Analysts project quantum could unlock ~$700B in value by 2035, and today’s leaders (Google, IBM, Microsoft and a swarm of startups) are already moving from labs to pilot-scale deployments.

We’re early—call it Tier Zero—but the groundwork is being poured now. For investors, operators, and cities, the winners won’t just be the companies building quantum; they’ll also be the ecosystems that house them.

What’s Changing

- Different physics, different outcomes: Qubits can explore massive solution spaces simultaneously, turning previously intractable problems into solvable ones.

- Near-term value is hybrid: Most progress will pair quantum with classical AI/ML and cloud—think workflows that hand off specific subproblems to quantum processors as the hardware matures.

- It’s broader than “tech”: Healthcare, finance, logistics, energy and defense all stand to benefit. If AI was about pattern inference, quantum adds a new toolkit for hard optimization and simulation.

How to Watch the Space (Without Picking Stocks)

We’re not an investment advisor—and this isn’t stock advice. But if you’re tracking quantum’s real-economy impact, these value streams are a practical lens:

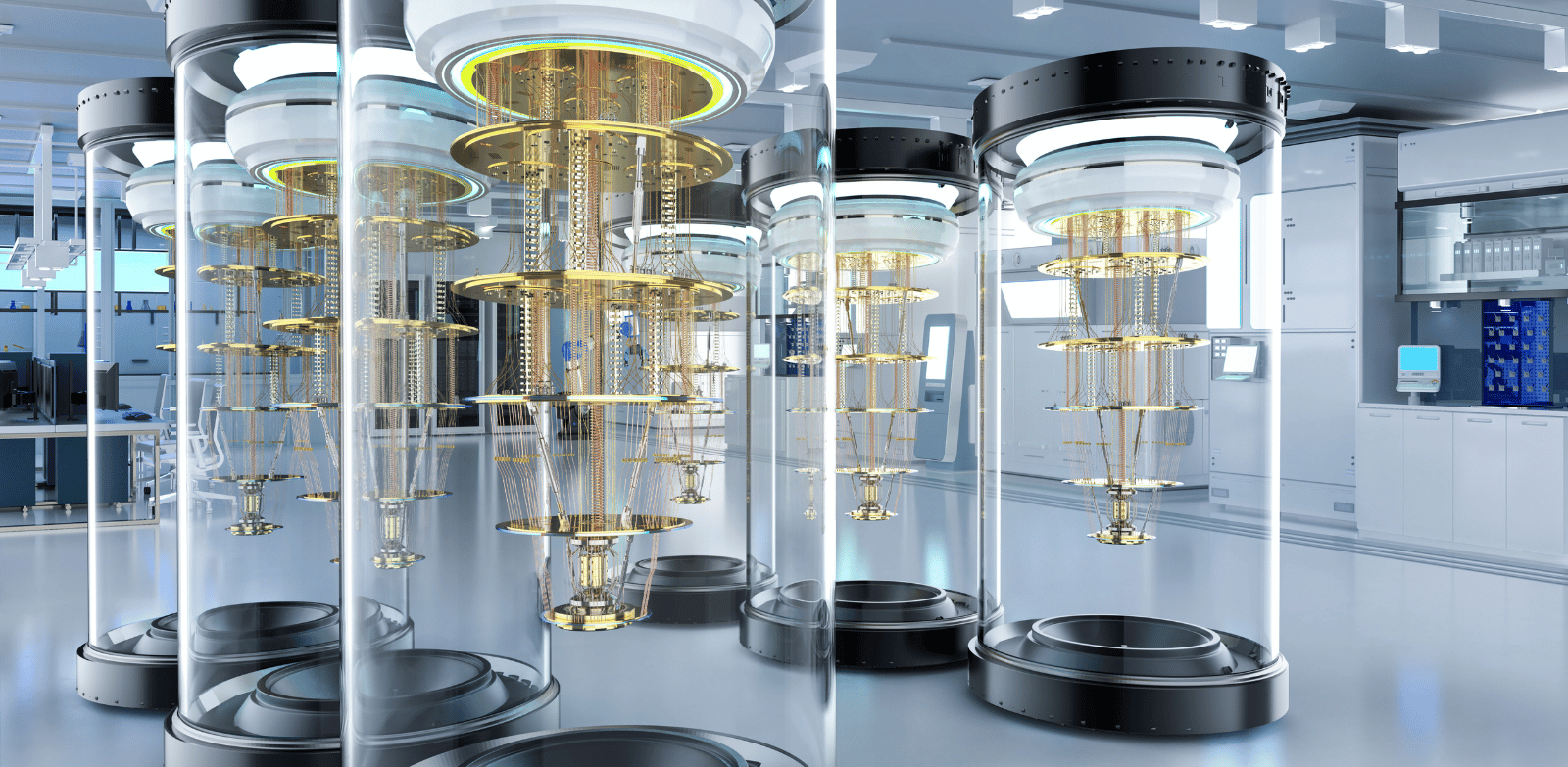

- Quantum hardware: Superconducting, trapped-ion, photonic and neutral-atom systems—plus the cryogenics, lasers, and control stacks that support them.

- Error correction & middleware: The “plumbing” that turns noisy qubits into reliable compute.

- Application layers: Chemistry, materials, routing/optimization, encryption—often integrated with AI.

- Cloud access: Most users will reach quantum via hyperscale clouds, similar to early GPU adoption.

The Real Estate Angle

Quantum and AI companies don’t lease “generic” space. They need specialized, flexible, power-dense environments—and strategic locations that help them recruit and scale.

What quantum-adjacent teams ask for:

- Hybrid footprints: Office + R&D labs + light manufacturing or prototyping in the same address.

- Power & cooling: High amperage, redundant power, chilled water, and pathways for future density.

- Vibration & EM control: Slab performance, isolation, and Faraday/EM-shielded rooms for sensitive equipment.

- Ceiling height & loading: Clearance for optical tables/rigs, grade-level access, and freight capacity.

- Connectivity & security: Dark fiber proximity, controlled access, compartmentalized suites.

- Speed to occupancy: Spec-built suites and permissive zoning to avoid long entitlement cycles.

What we’re doing at IPG:

Our team lives at the intersection of tech, biotech, and AI—and increasingly, quantum. We help companies secure lab-enabled offices, advanced R&D facilities, and campus solutions with the MEP, vibration, and security standards these programs demand. On the owner side, we advise on conversion strategy (what to build, where to build it, and which specs matter to actual tenants).

Why This Matters Now

- Tier Zero timing: Demand often starts with move-in-ready suites and grows in bursts as programs hit milestones. Flexible deal structures, phased expansions, and quick TI cycles win.

- Cluster effects: Proximity to AI talent, universities, chip/photonics supply chains, and data centers is a real advantage—especially in the Bay Area and other innovation hubs.

- Crossover with AI: The practical path to value is quantum + AI. Facilities that support both—GPU labs, robotics, wet labs, or precision optics—will lease faster and hold value longer.

Takeaway

Quantum is not science fiction—it’s infrastructure-heavy innovation that thrives in the right buildings and neighborhoods. If you’re planning a quantum/AI program or repositioning an asset for this demand, we can help you translate technical specs into real, leasable space—and align today’s footprint with tomorrow’s scale.