SF Office Leasing Reaches Pre-Pandemic Levels

AI momentum fuels renewals and new tenant demand

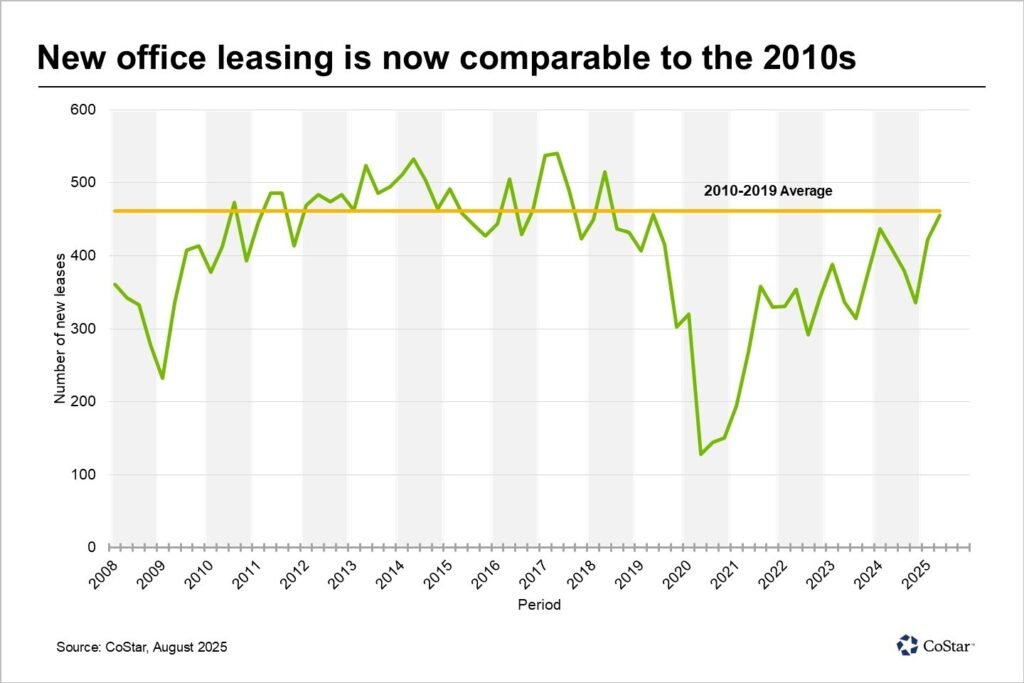

San Francisco’s office market is showing its strongest signs of recovery since before the pandemic. In the second quarter of 2025, leasing activity surged, with nearly 460 office leases signed. That figure is on par with the city’s average quarterly leasing volume during the 2010–2019 cycle — a decade defined by the rise of mobile, social media, and cloud technology firms.

Reaching those levels again underscores the momentum building in San Francisco’s commercial real estate market. This time, the driving force is the explosive growth of artificial intelligence, which is now beginning to influence a wider range of industries.

Leasing Market Conditions

Today’s recovery looks different from the last expansion. In the 2010s, leasing was sometimes constrained by limited supply. By contrast, San Francisco now has ample availability, with roughly 25% of office inventory on the market.

The average office space leased over the past year had been listed for 11.4 months — nearly double the 6.3-month average seen between 2010 and 2019. While demand is accelerating, it is set against a backdrop of historically high vacancy and longer listing times.

AI Leads — and Other Sectors Follow

Artificial intelligence remains at the forefront of new leasing activity, fueled by unprecedented venture capital investment. Recent funding rounds include $40 billion for OpenAI and $14 billion for Scale AI, giving these firms the resources to expand aggressively.

Notable recent AI leases include:

- Resolve.ai – 37,000 SF at 350 Rhode Island St. (August)

- Brex – 98,000 SF at 270 Brannan St. (July)

- Harvey AI – 93,000 SF at 201 Third St. (June)

But the impact of AI goes beyond the sector itself. Market participants note that growth in AI is acting as a catalyst for broader leasing activity. Professional services, law firms, and traditional tech companies are re-engaging in the market after years of downsizing.

Major Renewals Add Stability

In addition to new leases, renewal activity has strengthened, reflecting greater confidence among existing tenants:

- LinkedIn renewed 157,000 SF at 222 Second St. (June)

- Dodge & Cox renewed 84,000 SF at 555 California St. (April)

- Instacart renewed 57,000 SF at 300 Mission St. (June)

These commitments stand in contrast to the retrenchment seen just two years ago, when many tenants reduced footprints to match hybrid and remote work patterns.

Looking Ahead

San Francisco still faces a significant challenge: nearly 50 million square feet of available office space. How quickly AI-driven leasing — along with renewed demand from other sectors — can reduce that number remains to be seen.

What’s clear is that the San Francisco office leasing market has reached a turning point, with activity once again resembling the city’s strongest years. For landlords, investors, and tenants, this represents a moment of opportunity in a market regaining its footing.